UHCU Checking Accounts

Choosing a checking account is easy at United Heritage Credit Union. If you’re new to the Austin, Tyler or Central Texas area or if you’re just looking for a better way to bank, United Heritage is the place for you. UHCU offers four distinct checking options, including accounts specifically designed for teens and those looking for a second chance at banking. Free Mobile Banking, Online Banking and eStatements come standard with all UHCU checking accounts. Review our checking options and apply online today.

More Checking Account Benefits

Additional Benefits

There's an option for everyone.

Check Out Our Debit Card Designs

UHCU is offering multiple debit card designs for our members. Card designs feature a variety of options, in both horizontal and vertical orientations. And, debit cards are now contactless! Click below to see all instant-issue and mail in options.

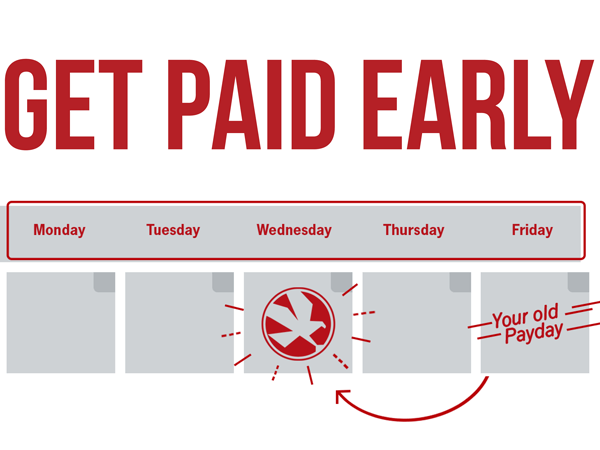

Get Paid Early

Open an account with UHCU and you could get paid up to two days early. It's as easy as 1-2-3.

- Open a UHCU account

- Set up direct deposit for your paycheck

- Receive your paycheck up to two days early****

Deposit checks anytime, anywhere

If you can't make it to a branch or ATM, did you know that you can deposit checks with our mobile app? A time saver and a serious game changer for busy people (aren't we all?) Download our app today and start banking on the go.

Membership/Regular or Student Savings required. Regular Savings account required for all checking accounts. Par value of one share is $1.Programs (including, without limit, fees, rates and features) subject to change without notice. See Fee Schedule for applicable fees.

Instant Issue Visa® Debit Card: Get an Instant Issue Visa® Debit Card for just $5. Daily transaction limits applied to Teen Checking account debit cards. Copies of cleared checks endorsed within 18 months of request date are free via Online Banking.

*Web BillPay is free when it is actively being utilized. An inactivity fee of $6.95 is assessed if there is fewer than one (1) payment processed during the Web BillPay calendar monthly billing cycle.

**Overdraft Protection is available for all checking accounts from the designated savings account up to the amount of funds on deposit.

***Excludes overdraft transfers.

****United Heritage makes your pay available as soon as it is received, which in many cases can be up to two days before your scheduled payday. Employers control the timing of providing their payroll funds to United Heritage. Early deposit of your payroll is not guaranteed.