Personal Loans

A UHCU personal loan is great if you're in need of cash but don't want to deal with high-interest credit cards or high rates. Use a personal loan to consolidate debt or pay for an unexpected expense. With a fixed rate and fixed terms, you can count on predictable monthly payments that make budgeting easier. Let a UHCU personal loan specialist help you take the hassle out of getting the money you need.

Need cash? Apply online for personal loan.

Line of Credit

Have the peace of mind that you'll be able to handle any fluctuations in your finances by establishing a personal line of credit. Access funds from your line of credit whenever you need, for whatever you need. You can even add your personal line of credit as overdraft protection to your UHCU checking account. In the event you have unexpected expenses, your line of credit will protect you against costly overdraft fees.

Manage your cash flow better with a line of credit.

Share and Certificate of Deposit Secured Loans

Share and certificate of deposit (CD) secured loans allow you to continue earning interest while using the funds from your savings account or CD as collateral for a loan. A share or CD secured loan is the best loan option if you're looking to establish credit, re-establish credit or borrow money without a co-signer.

Build your credit with a share or CD secured loan today.

Personal Loans Insights & Advice

Step-by-Step Guide: Hail Damage Next Steps

A recent hailstorm caused widespread damage to homes and cars in our community. If your home or car was damaged in the storm, you may be wondering what to do next.

Read More

4 Scams You Should Know About

As fraud constantly evolves, United Heritage Credit Union reminds members to remain vigilant when it comes to their finances. Outlined in this blog post are a number of common scams that you can avoid if you are attentive and armed with the right knowledge.

Read More

Top 7 Things to Purchase in January

January is a great time to pick up some great deals, and we’ve compiled a list of the top 7 items that are usually discounted in the New Year!

Read More

5 Tips for Buying a New Car

Whether you're buying a new vehicle or a pre-owned vehicle that’s new-to-you, the experience should feel rewarding. Unfortunately, many people find buying a new car to be stressful. Don't let the negotiation process and fine print prevent you from enjoying your new set of wheels! Consider these tips the next time you're car shopping.

Read More

3 Must-Dos Before Buying a Home in Austin

With an average list price of $414,563 for a four-bedroom, two-bathroom house, Austin-area homes are the most expensive in the Lone Star State. Check out these money-saving tips to ensure you don't overstretch your budget when buying a home in Texas' capital city.

Read More

8 Auto Insurance Myths

Confused about auto insurance? You're not alone. Many myths and misconceptions swirl around this essential protection, leading to costly coverage gaps or overspending. At UHCU Insurance Services, we're committed to helping you make informed decisions about your car insurance. So, let's debunk some common myths and ensure you're getting the right coverage at the right price:

Read More

5 Ways for Austin Drivers to Minimize Auto Expenses

Although sitting in traffic can take a toll on the health of your vehicle, following a few simple guidelines can help ensure you're not spending a fortune on your car.

Read More

Does Filing an Auto Insurance Claim Mean Higher Premiums?

Hit a bump in the road with your car? While accidents happen, navigating the aftermath, especially when insurance is involved, can feel like a winding road. One question that often pops up: "Will my auto insurance premiums increase after filing a claim?"

Read More

Don't Get Blindsided: Understanding Auto Policy Cancellation vs. Nonrenewal

Ever wondered why your auto insurance might not be renewed? It's a scenario that raises eyebrows and questions. At UHCU Insurance Services, we believe navigating the twists and turns of insurance shouldn't leave you in a tailspin. So, buckle up as we untangle the difference between cancellation and non-renewal, helping you keep your car cruising smoothly.

Read More

Love Your Savings: 10 Steps to Increase Your Savings

Saving money is one of the smartest financial habits you can develop. Whether you're preparing for a major milestone, planning for retirement, or simply aiming for peace of mind, strong savings can make a world of difference. At UHCU, we believe that anyone can cultivate a savings plan they feel confident about, no matter where they are in their financial journey.

Here's how you can take meaningful steps to boost your savings and achieve your financial goals.

7 Steps for First-Time Car Buyers

Are you a first-time car buyer? Before heading to the dealership, check out these steps on how to best buy a car.

Read More

8 Best Tips for Holiday Road Trips

Road trips - the quintessential American mode of travel that highlights the joys of the holidays like no other activity. It's a tradition, much like listening to your Uncle’s high school football highlights, which can set your teeth on edge. If you are lucky though, you'll have your aunt’s pecan pie to look forward to and make the whole trip worth it. Here are some tips to get you safely to into your relatives’ warm and cozy kitchen.

Read More

Managing Debt in 2025: Practical Tips for Financial Freedom

As we begin 2025, many are focusing on financial goals, and for many, that means tackling debt. With rising living costs, it’s important to take a proactive approach to managing what you owe. Whether it’s credit cards, student loans, or medical bills, starting the year with a clear strategy can help reduce stress and put you on the path to financial freedom.

Read More

Mastering Your Finances: Budgeting and Building an Emergency Fund Made Simple

Managing your finances doesn't have to feel overwhelming. With just a few practical steps, you can take control of your money, reduce stress, and set yourself up for future success. Whether you're tackling expenses or saving for unexpected emergencies, the right strategies can make all the difference. Let’s dive into two essential habits: creating a budget and building an emergency fund.

Read More

Navigating the 2024 FAFSA Fiasco: How UHCU Can Provide Financial Relief

At United Heritage Credit Union, we believe in providing support to our members and people in the community at every stage in their life. We recognize that people looking to continue their education are often looking for support and ways to alleviate any financial stress. The Free Application for Federal Student Aid (FAFSA) has long been the gateway to accessing financial aid for college-bound students. However, recent technical errors from The Education Department have affected the FAFSA process and left many students facing uncertainty and financial strain. UHCU is looking to help alleviate financial stress families may be facing, and support students with appropriate loans and the financial support they may need for their education.

Read More

Setting and Reaching Your 2022 Goals

There’s a lot of talk around the new year about setting new goals and revitalizing old ones. Each January, we declare that this is the year where we will get healthier, get a better job or take that dream vacation. As always, life takes over and we often forget the goals we set until the next new year rolls around. How can we work to make realistic goals, and more importantly, actually reach them?

Read More

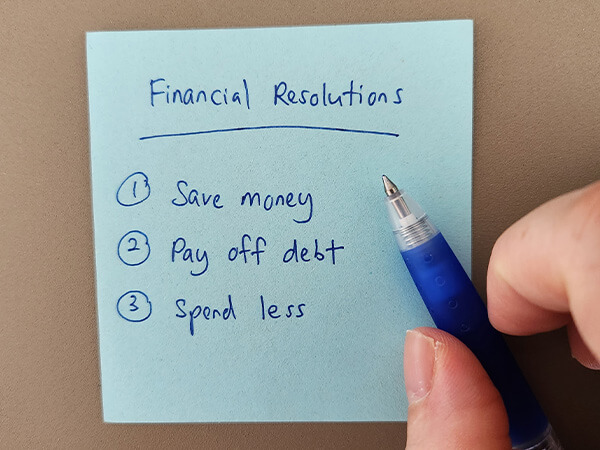

3 Financial Resolutions

One of the best things about beginning a new year is getting a fresh start. It’s nice to press that imaginary “Reset” button on January 1 and forget about the pitfalls of the previous year. Some of our favorite resolutions involve finances (surprise, surprise) – planning to spend less and enjoy more, or save more and worry less. While these are great ideas in theory, sometimes it’s difficult to follow through with such goals. So, we’ve rounded up three, simple financial resolutions to help you keep your finances under control all year long.

Read More

5 Reasons to File Your Taxes Early

Doing your taxes early really is worth the effort. The majority of Americans end up with a return, so filing earlier means that for many, you’ll have money back in your pocket sooner. Besides having some cash, here are 5 other reasons to get down to work and get your return in as soon as possible!

Read More

5 Steps to Creating a Budget

One of the best decisions you can make for your financial future is to create and then stick to a budget. Taking a deep look at your finances can be intimidating, but it’s important to do especially if you are looking forward to buying a home, retiring or making another large purchase. Putting a budget together takes some work, but once it’s done, you’ll find it's easy to maintain and to adjust when needed.

Read More

6 Holiday Travel Tips

This is a great time to visit friends and family. Unfortunately, holiday travel can cause your budget to suffer due to high-priced airline tickets, unexpected lodging expenses and more. Therefore, we’ve put together six tips to keep in mind when planning trips during the holidays.

Read More

Child Tax Credit Payments - What You Need To Know

The American Rescue Plan, which expanded the income tax credit program for families with children for 2021, has kicked off monthly child tax credit payments that began on 7/15/2021.

Read More

First-Time Homebuyer: 10 Steps to Homeownership

Buying a home is an exciting experience, but it can also be overwhelming. It will probably be the single largest purchase you ever make and it requires thoughtful planning. Therefore, all first-time homebuyers should take a few things into consideration before they head down the path of homeownership. Here are ten important steps to follow when purchasing a new house.

Read More

Cutting Your Energy Costs - 10 Easy Ways to Reduce Your Electricity Bill

Reducing your bill can lead to significant long term savings and we’ve got some ideas to help get that cash back into your pocket!

EMV Cards: What You Need to Know

An EMV card is a standard-size credit or debit card that has a microchip embedded on the front of the card in addition to the traditional magnetic strip on the back.

Read More

How Much House Can You Afford?

If you’re like most Americans, the question isn’t, “Am I going to finance my new home?” But rather, “What mortgage payment can I afford?” Before you begin hunting for a new house, there are many factors to consider.

Read More

Financial Resolutions for the New Year

We're bringing back our first post of 2014 since it contains a lot of valuable information regarding financial resolutions that are still relevant. One of the best things about beginning a new year is getting a fresh start. It's nice to press that imaginary "Reset" button on January 1 and forget about the pitfalls of the previous year. Some of our favorite resolutions involve finances (surprise, surprise) – planning to spend less and enjoy more, or save more and worry less. While these are great ideas in theory, sometimes it's difficult to follow through with such goals. So, we've rounded up three, simple financial resolutions to help you keep your finances under control this year… and beyond.

Read More

Financial Budgeting for the New Year

Celebrating the New Year is often a time of renewal. We sometimes resolve to make the New Year “our year,” start new diets, begin new exercise regimens and wipe out the things in our lives that didn’t quite work out. Financially, clearing the slate and starting over again is one way to set the New Year off on the right foot. Creating and using a budget can help you have an easier time during tax season, lets you find ways to save and can help you spend more wisely. Here are a few tips for getting a budget started.

Read More

Get Financially Fit This Year

The beginning of the year is a great time to get your finances in order. Though money management can seem a bit daunting at first, it doesn't have to be. Check out our advice below to see how you can make this the year you set a strong foundation for your financial future.

Read More

Holiday Budgeting - Avoiding Over Spending

This year has been unprecedented, and many of us have adapted to online shopping, and therefore an increase in our online spending. As a country, we generally overspend our budgets each year. A few purchases here and there can really start to add up and with the ease of online shopping and savvy offers from advertisers, it’s easy to see why we spend so much. With the holiday season in full swing, it’s time to take a look at your spending and how you can stay within your budget.

Read More

Managing Credit Card Debt

Credit card debt is one of the biggest financial issues for many Americans. Millions of us carry month-to-month balances on credit cards, and many people have found problems just making minimum payments. Credit card debt can be a barrier to owning a home, buying a car or even saving towards retirement. Managing credit card debt can be overwhelming, but there are several ways to lower debt or pay them off completely. Here are a few tips for managing your credit card debt and improving your financial picture:

Read More

Maximize Your Refund with These Tax Tips

Preparation is key to guaranteeing the annual tax deadline doesn't overwhelm you. Check out the following tips on how to reduce stress and increase your refund, or decrease the amount you owe.

Read More

Now Is the Time to Plan Your Summer Getaway

Now that a COVID-19 vaccine is becoming more widely available, it looks like there may be an end to our time in quarantine. This means that all the things we’ve put on hold like vacations or seeing family may soon be possible again. If you’ve been longing to travel and are wanting to see the sights this summer, it’s not too early to start planning your trip now as there may be a bit of a rush as summer gets closer.

Paying For Higher Education: 5 Tips

The cost of higher education continues to outpace inflation, and is perhaps the biggest expense that some people will ever incur outside of buying a home. Tuition for public colleges averages $9,000 a year, but add in living expenses, books and other fees, and you’ll see a tab that’s closer to $20,000 for an undergraduate degree. If you choose a private school, those numbers just get higher and higher. Here are 5 tips that may be helpful when trying to navigate the expenses of higher education.

Read More

Planning for Your Next Vacation

Once the holidays are over and we are back to the everyday grind of work and school, it is no wonder that many of us start to dream about warm weather, vacations and time to actually relax. Time away has been shown to reduce stress, improve mental health and improve relationships. Also, planning a vacation has been shown to help keep you motivated in achieving other goals. If you’ve decided that a getaway is in the plans for you, here’s some financial tips for making that happen.

Read More

Save for Your Dream Home with a Homebuyer Savings Account

Are you dreaming of owning your own home? A Homebuyer Savings Account can be a powerful tool to help you reach that goal. These specialized accounts offer a variety of benefits that can make the process of buying a home more achievable.

Read More

Refinancing Student Loans - What You Need to Know

Student loans can be a huge burden to many Americans, and there has been much talk of government intervention in helping relieve some of the debt, but in the meantime, many are putting up with high payments and high interest rates. The main reasons for refinancing are to lower interest rates, lower payments, and to consolidate several loans into one. These have some attractive advantages including possibly lowering your monthly payment, shortening the length of a loan, and limiting the number of lenders you may have to make payments to.

Read More

Simple Strategies to Save More Without Sacrificing Fun

Saving money doesn’t mean giving up the things you enjoy—it’s about making smarter choices and turning small changes into big opportunities. By identifying unnecessary expenses and making the most of unexpected income, you can build a healthier financial future without feeling deprived. Let’s explore two practical ways to grow your savings.

Read More

Saving for Your First Home: A Step-by-Step Guide

Saving for your first home requires careful planning and smart financial strategies. This guide offers steps to help you budget, maximize savings, and explore down payment assistance programs to achieve your homeownership goals.

Read More

Smart Saving Strategies

Saving money isn't just about cutting costs - it's about creating habits and systems that make saving easy and effective. If you're ready to take control of your financial future, focusing on the right tools and strategies can make all the difference. We'll explore two essential steps to supercharge your savings.

Read More

Smart Ways to Save with United Heritage Credit Union

Saving money doesn’t have to be complicated or stressful—especially when you take advantage of the unique benefits offered by United Heritage Credit Union (UHCU). From competitive rates to innovative programs, UHCU makes it easier than ever to build healthy savings habits while keeping more of your hard-earned money. Here’s how we’re helping you save smarter.

Read More

Student Loans: Government vs. Private Funding

The cost of education continue to climb higher each year and as a result, many students have to borrow money to pay for the increased expenses. College expenses have vastly outpaced inflation rates for the past five years and currently do not show any sign of slowing down. Deciding on a loan can have long term implications on your finances, so it is important to understand the difference between government loans and private loans.

Read More

Take Your Savings to the Next Level with Smart Investments

Saving money is a great first step, but growing it is how you unlock greater financial potential. Once you’ve built a solid savings foundation, exploring investment options can help you maximize your money and secure your future. Here are some accessible ways to start investing and tips for keeping your savings plan adaptable as life evolves.

Read More

The 5 Pillars of Financial Literacy Everyone Should Know

Let's be real - most of us weren't taught how to manage money in school. Yet, financial literacy is one of the most valuable life skills you can have. It's not just about making money; it's about keeping it, growing it, and using it wisely.

Whether you're looking to get out of debt, save for a big goal, or build long-term wealth, there are five core principles that serve as the foundation of smart money management. Let's break them down in a way that actually makes sense.

Virtual Currency: 5 Things to Consider

Although virtual currencies like Bitcoin, Dogecoin and XRP have been receiving a lot of press lately, many people are unaware of what they are, how they’re used or the risks associated with them. Virtual currencies are electric money with growing global acceptance, even though they aren't tied to actual coins or bills. They offer an innovative, inexpensive and flexible method of payment via the internet. However, due to how these funds are exchanged and their dependence on the processing power of vast networks of private computers around the world, they pose a challenge to regulators and can cause certain issues for those who adopt them as a payment method.

Read More

What are Insurance Scores and Do They Affect Your Auto Insurance Rates?

Ever wondered why your friend with a "clean driving record" pays more for auto insurance than you? It might have something to do with insurance scores. But what exactly are they, and how do they impact your rates?

Read More

What Determines the Price of an Auto Insurance Policy?

Ever wonder what factors determine the cost of your auto insurance? The answer lies in the varying factors that insurance companies use to determine your individual risk profile and, ultimately, your premium price. Don't worry, we're here to shed light on the most common determinants of your auto insurance cost.

Read More

Protecting Yourself from Identity Theft

Identity theft occurs when a thief steals someone's personal information to commit fraud. Generally, the thief will use a stolen Social Security number or other personal information to open new accounts, make purchases or get a tax refund.

Read More

What is Auto Insurance?

Hitting the gas on your car feels freeing, but the thought of navigating auto insurance can leave you feeling stuck at a red light. UHCU Insurance Services is here to shed light on the intricacies of insurance, ensuring you cruise with confidence towards financial security.

Read More.png?width=600&height=450&ext=.png)

What is Estate Planning?

Estate Planning is simply the process of making it clearly known how you want your estate to be handled after you pass or if you’re incapacitated and unable to handle things on your own. Click here to learn more.

Read More

What is FAFSA? Securing Financial Aid For Your College Dreams

The Free Application for Federal Student Aid (FAFSA) is your key to unlocking financial aid for college. While it may seem daunting, breaking it down into simple steps can make the process a breeze.

Read More

What Is Passive Income and How Can It Work For You?

If there’s anything that the last few years have taught us it's that every plan should have a backup plan. Financially, there are several ways to create security around an income. In the past, if you needed more income often the path meant getting a second job. The gig economy and advent of self-scheduling jobs like driving for a ride share company or doing food delivery have made earning extra cash easier than ever. But passive income could be an even better way to pad your accounts and not spend a lot of extra time doing it.

Read More

What is Covered By an Auto Insurance Policy?

Hitting the open road feels liberating, but it's crucial to be prepared for the unexpected. And that's where your trusty auto insurance policy comes in – your financial guardian angel in case of fender benders, stolen vehicles and natural disasters. But with all those confusing terms and coverages thrown around, navigating the world of car insurance can feel overwhelming. Fear not, fellow drivers! This blog will peel back the layers and dissect the six essential coverages of an auto insurance policy, empowering you to choose the shield that keeps you cruising confidently.

Read More

Who Needs an Estate Plan?

Short answer: Everyone. It’s easy to try and convince ourselves that we don’t need an Estate Plan. But the reality is, we would all be better off if we were planning a little more for our future. Click here to learn more

Read More

What is the Difference Between a Will and a Trust?

A Will lets you nominate guardians for kids and pets, designate where assets go, and specify final arrangements. A Trust can provide greater control over when and how your assets are distributed. Keep reading to learn more.

Read More

Why Savings Goals Matter

When it comes to creating a successful savings plan, the first and most crucial step is defining a clear savings goal. A goal gives your financial efforts direction, purpose, and a reason to stick with your plan. Without it, saving money can feel like a never-ending chore rather than a rewarding journey.

Read More

Free Up Funds with Skip-A-Pay

With our Skip-A-Pay program, you can temporarily pause your loan payment, giving yourself and your budget a much needed break. Click here to learn more about this program.

Read MoreUpgrade to an EMV Chip Debit Card Today!

EMV Chip Debit Cards are available for United Heritage Credit Union members! Call or stop by any full-service UHCU branch to upgrade your card today.

Read More